What is Cryptokami?

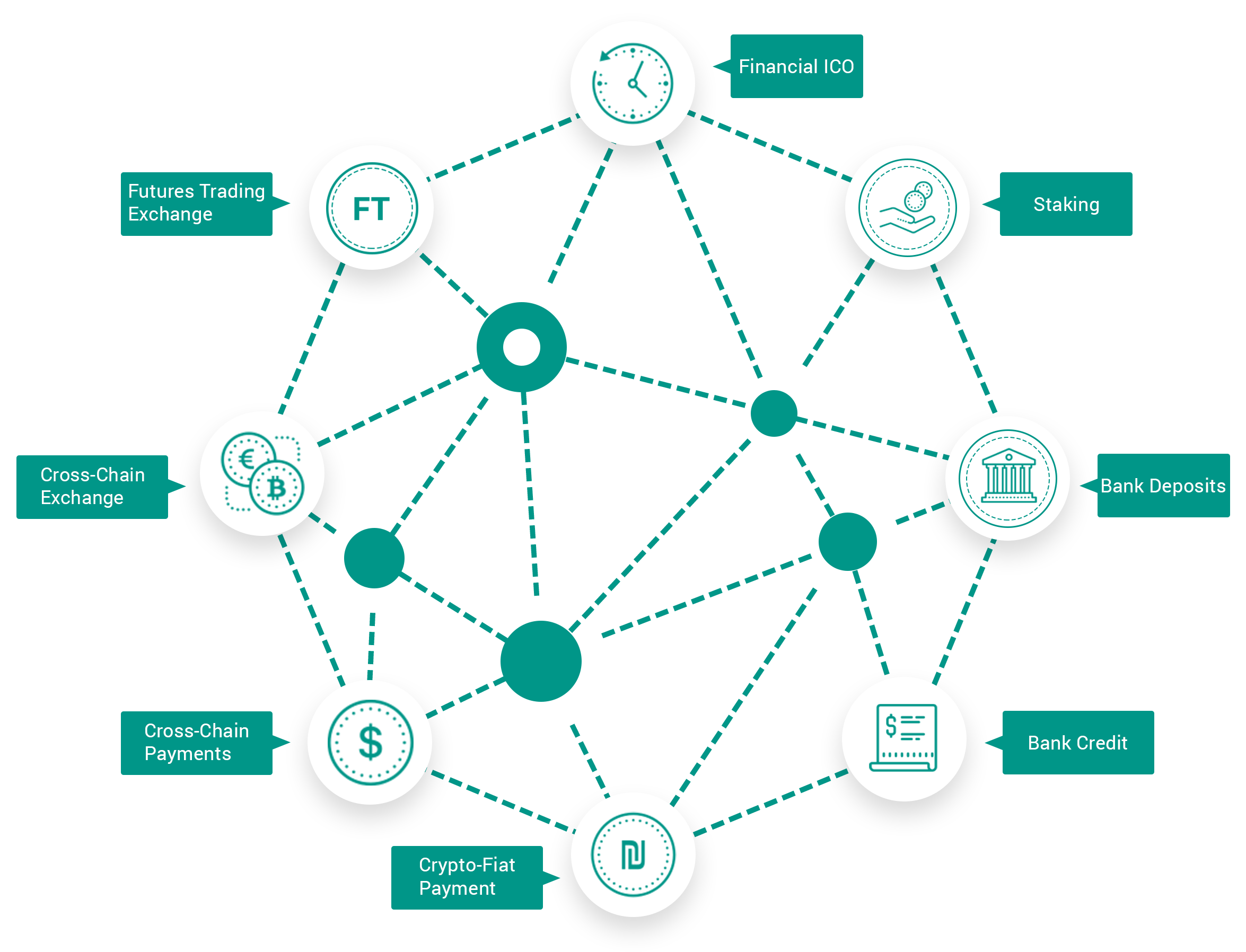

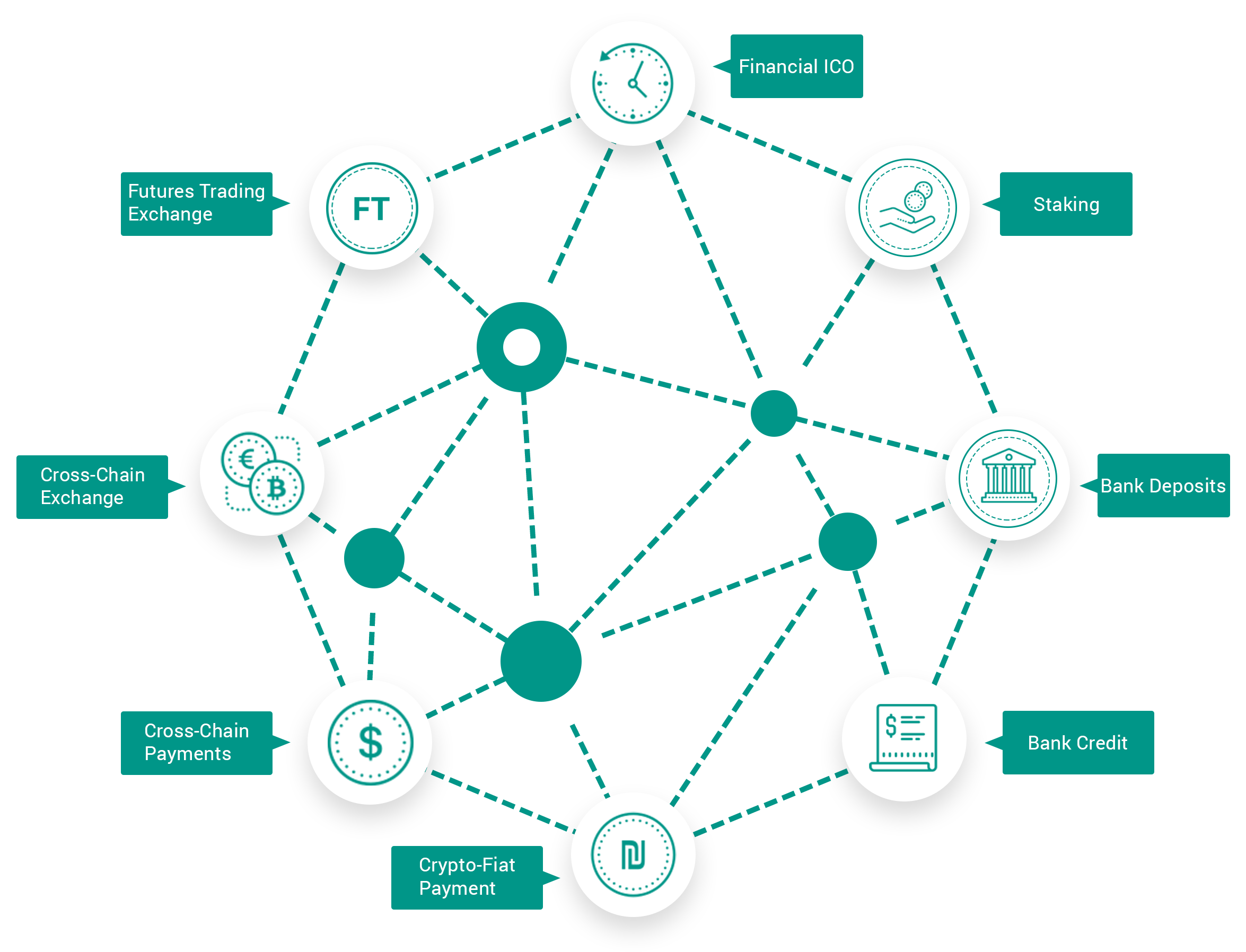

While all of the "Blue Chip" such as Bitcoin, Ethereum, Ripple, Cardano, Stellar ... are focused on transaction processing, CryptoKami focuses on the automatic regulation of crypto flow in its ecosystem by the Compulsory Reserve mechanism (Comreme Algorithm) via Regulate contract. CryptoKami's technology together with KAMI tokens will reestablish a regulated balance for the crypto market in the Wild-West industry.

CryptoKami issues and regulates limited 210M KAMI tokens under Compulsory Reserve Mechanism based on Comreme Algorithm via Regulate Contract, so KAMI tokens SUPPLY decreasingly in future

Next third party Financial ICOs owner and end user as investor, holder, trader, banking services’ user must use KAMI tokens for their needs to use a lot of functions so create massive increasingly DEMAND on KAMI tokens in future

As such, according to the rule of SUPPLY and DEMAND, CryptoKami has created a strong and sustained SELF-GROWTH ENGINE for KAMI tokens in both of short-term, medium and long-term.

Our rich & easy to learn SDK with detailed documentation

will help you turning your ideas to real products very smoothly

(SAFT - Compliant Token Sale Framework ) for third party called CryptoKami’s Finiancial Institute Alliance (CFIA) conduct their ICOs on CryptoKami platform.

All the main blockchains now focus on transaction processing because they are faster and have lower fees, are more secure, and save energy, among other reasons. But these improved features do not help protect the value of crypto against the rumors and policies of different governments. That is the vulnerability of the current crypto market. Why is this happening? Because cryptocurrencies are currently not regulated scientifically. Hence, CryptoKami was born to create a third-generation blockchain system with the mission of providing an ecosystem infrastructure for third-party financial applications and end-users. This ecosystem creates a real, rich, and powerful use for its crypto, the KAMI token. At the same time, the flow of KAMI tokens in the ecosystem is regulated under the Compulsory Reserve Mechanism based on the Comreme Algorithm (CryptoKami's invention) through the Regulatory Contract (CryptoKami's invention). At this point, CryptoKami releases and regulates KAMI tokens through third-party financial applications that operate on it, operating similarly to the US Federal Reserve (FED) regulating the dollar flowing through commerce banks. When KAMI tokens are put into use and circulation will be protected against rumors and governments’ policies and laws. The flow of KAMI tokens will be automatically regulated so that the supply growth rate is always slower than the demand growth rate, which fully applies the supply and demand rule to affect monetary value. This is the SELF-GROWTH ENGINE of KAMI token to ensure a long-term sustainable growth scenario that is less vulnerable to market rumors, manipulations, policies, and regulation by governments. CryptoKami's invention for end-users, third parties, and the rest of the world leverages the strengths and weaknesses of existing blockchain systems to the market. The cryptocurrency market is now in the early stage and is like the WILD-WEST industry, becoming less vulnerable, creating a more sustainable development, and becoming more prosperous.

All countries except those where the ICO Investment Prohibition Act is in effect, such as the United States, South Korea, China, and Canada.

Japan, Cyprus and the global Developer Community.

A KAMI staker gets up to 10% per year.

Both B2B and B2C models.

Buy through a private pre-sale or crowdsale ICO

Sell on crypto exchange after ICO

The Comreme Algorithm was invented by CryptoKami. The Compulsory Reserve Mechanism runs on the Comreme Algorithm through the Regulatory Contract (CryptoKami's invention). The Comreme Algorithm combined with the Regulatory Contract is a core technology and key feature of CrytoKami’s third-generation blockchain. This core technology allows automatic regulation of the supply and demand of KAMI tokens circulating on the CryptoKami ecosystem.

The CryptoKami blockchain is based on Cardano open source. It inherits the advantages of Cardano POS open source in on-chain and cross-chain transaction processing. At the same time, it has developed two inventions to improve and upgrade the Cardano blockchain. This improvement allows the CryptoKami blockchain to further regulate the supply and demand of KAMI tokens circulating in its financial applications ecosystem.

Open-source Cardano (Ouroboros proof of stake algorithm) + compulsory reserve mechanism + Comreme Algorithm (CryptoKami’s invention) + Regulatory Contract (CryptoKami’s invention) = 3rd-generation blockchain infrastructure of CryptoKami

If you want to visualize future value growth charts, you need to know the secrets of currency dominated by trust and the SUPPLY-DEMAND rule (white paper - chapter 6). These massive needs are the drivers of short- and long-term value growth for KAMI tokens. We call it the SELF-GROWTH ENGINE of the KAMI token.

For financial third parties

CryptoKami is a Decentralized Reserve System. The CryptoKami platform is now built like the Ethereum but only for financial services organizations who will launch their ICOs and operate based on CryptoKami’s POS blockchain through its cryptocurrency named KAMI tokens. Additionally, CryptoKami operates on its own behalf like the US Federal Reserve (FED) by distributing and regulating the system’s KAMI Tokens based on the principle of the Compulsory Reserve Mechanism (Comreme Algorithm - CryptoKami ‘s invention) through the Regulatory Contract (CryptoKami’s invention) so financial service organizations operate based on CryptoKami platform and act as commercial banks on the system. The CryptoKami platform issues and regulates the limited 210M KAMI tokens under the Compulsory Reserve Mechanism (Comreme Algorithm) through the Regulatory Contract for various needs corresponding to its various main functions. While all the”Blue chip” cryptocurrency such as Bitcoin, Ethereum, Litecoin, Ripple, Cardano, Stellar are focused on transaction processing, CryptoKami focuses on the automatic regulation of cryptocurrency flow in its ecosystem by the Compulsory Reserve mechanism (Comreme Algorithm) via the Regulatory ContractContract. CryptoKami's technology and KAMI tokens will reestablish a regulated balance for the cryptocurrency market in the Wild-West industry.

The answer is yes. Our technical support is available 24/7. All issues of investors and partners related to wallets, deposits, transactions, and security will be supported immediately by CryptoKami’s programmers and its developer community.

We are a group of technology and blockchain professionals and a financial organization from Japan.

Because of its similarity to bitcoin and some other cryptocurrency, the anonymity of development teams, users, and investors will help CryptoKami not to be overridden by different legal barriers between countries. A sustainable, liberal, and democratic action is based on the principle of a decentralized consensus, which brings prosperity to all participants in the CryptoKami ecosystem.

We started the project in early 2017 with another domain, but we then found that the domain name CryptoKami.com is more suitable and should change in December 2017.

KAMI (Kami Token) is standalone Blockchain Token and an open protocol for decentralized exchanges. It is intended to serve as a basic building block that can be combined with other protocols for increasingly sophisticated control. It allows KAMI Token owners to diversify their portfolio by accessing tags related to the price of the property. KAMI Token allows property owners to unlock valuable assets by creating and selling or borrowing their property cards. The platform extends the liquidity and transparency of assets and reduced transaction costs. Provides the owner of the KAMI Token detection and price diversity across multiple asset classes as it allows the creation or posting of third-party notifier in accordance with the disclosure and management regulations, and contract of KAMI Token .

Token KAMIs